How to Upload Multiple Pages for I-864a

If you're petitioning someone to come to the U.S. and you don't meet the income requirements non only do you lot need to fill out an I-864 but also Form I-864A, Contract Between Sponsor and Household Member. This course shows that at that place is an eligible member of the household willing to combine their resources (income and/or assets) with the primary sponsors to meet the financial requirements. Our guide volition take y'all through I-864a instructions, articulation sponsor and household member definitions, and more.

Course I-864A Instructions

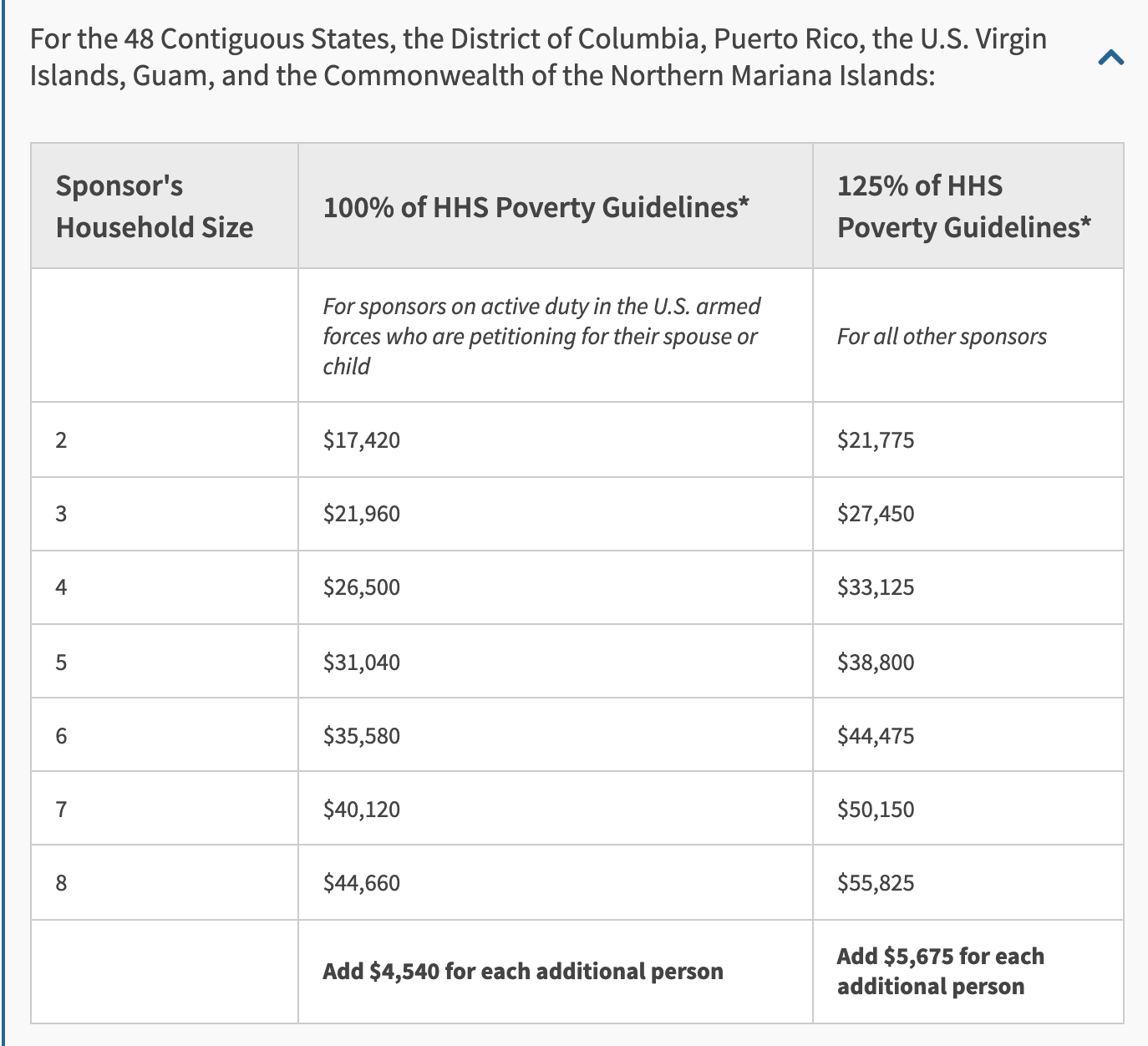

Are you trying to sponsor a relative or spouse to immigrate to the United states? If y'all answered yes, you more than than likely will need to complete Form I-864, Affidavit of Back up, accepting financial responsibleness for the sponsored immigrant until they either become a U.S. citizen or fulfill 40 quarters of piece of work (approximately ten years). If your income does not satisfy the requirement, equal to or higher than 125% of the U.Due south. poverty level for your household size, then you have the option to include a household member or dependent's income and/or assets to meet the income requirement, should they determine to take the financial liability.

Permit'south say, for case, the sponsoring petitioner wants their fiancé from Brazil to emigrate to the United States, but unfortunately, their income does not satisfy the requirement. If the petitioner lives with a relative or dependent, like a son or daughter, who works regularly and is willing to combine resources with the main sponsor to run into the financial requirement, then they can do so by submitting Course I-864A along with the I-864. They must file these forms together.

If a regime program provides the sponsored immigrant with whatever financial assistance based on need, both sponsors would be responsible for paying dorsum the monies to the government within a certain menses of fourth dimension. However, be aware that if the government decided, either one of the sponsors could be responsible for paying back the entire amount because the liability is considered "joint and several."

Who is Considered an Eligible Household Member in I-864A?

Not just anyone tin sign Grade I-864A. To be considered a household member for the Contract Between Sponsor and Household Member, the individual must be at least xviii years quondam and meet i of the post-obit:

- Be the parent, developed kid, spouse, or sibling of the main sponsor and live in the same physical residence as them

- Be lawfully claimed as a dependent by the main sponsor in their most recent federal revenue enhancement return; not required to live in the aforementioned chief residence

- The immigrant can pool financial resources with the petitioning sponsor only if the petitioning sponsor intends to rely on the immigrant's connected income to satisfy the fiscal support requirements.

- For this situation to exist considered, ane of two scenarios must occur:

- The intending immigrant must have the same principal residence as the sponsor. In addition, they need to demonstrate that their income will continue (from a legal source), fifty-fifty after obtaining lawful permanent residence. That means if the immigrant is working without legal potency to practise and so, they volition non be eligible by USCIS' standards OR:

- The intending immigrant is the chief sponsor'due south spouse, and again they need to demonstrate that their income volition go along (from a legal source), even later obtaining lawful permanent residence

- For this situation to exist considered, ane of two scenarios must occur:

Multiple individuals can decide to provide financial support for the sponsored immigrant, simply they must sign a separate Grade I-864A.

Form I-864A is an attachment to Form I-864. The I-864A should be completed if a household fellow member is willing to contribute to the primary sponsor's income to meet the fiscal requirement equal to or in a higher place 125% of the U.S. poverty level for their household size. If a joint sponsor agrees to co-sponsor the immigrant, so they complete a dissever I-864.

What is the deviation between a joint sponsor and a household fellow member?

A joint sponsor and household member are not the aforementioned things. A joint sponsor is too willing to have legal responsibleness for supporting the intending immigrant. They must meet the same criteria every bit the main sponsor (125% income requirement without pooling incomes with the other petitioning sponsor). However, they do not need to be related to the immigrant. They would need to consummate a carve up Form I-864, Affidavit of Support, non Form I-864A.

I-864A Instructions Footstep-past-Stride

Form I-864A consists of eight pages and should exist filled out by the household fellow member like-minded to sponsor the immigrant along with the primary petitioning sponsor. All answers should be typed or printed in black ink. The tiptop department labeled For Authorities Use Only should exist left blank. If an attorney or accredited representative completes the form, the attorney will need to write in their Land Bar Number.

Section 1: Information About the Household Member

The first part of the form asks for bones information about the household fellow member who has agreed to pool income with the principal sponsor. Fill in the full name, mailing address, physical address, appointment of birth, place of birth, Social Security Number (if applicable), and USCIS online account number (if applicable).

If y'all are the intending immigrant and also the sponsor's spouse, cheque box 1.a. If you are the immigrant and also a member of the sponsor'southward household, check box ane.b. If yous are related to the sponsor as a spouse, son or daughter, parent, blood brother, sister, or other dependent and nonthe immigrant but part of the sponsor's household, check the appropriate box in 1.c.

Section 3: Household Member's Employment and Income

In this section, the household member must answer questions regarding current employment, whether cocky-employed, unemployed, or retired. Plus, write the household member's current individual income amount in line 7.

Section four: Household Member'southward Federal Income Tax Information and Assets

This section requires the household member to indicate whether they accept filed a federal income tax return for each of the three past years. You volition demand to attach a photocopy or transcript of the most contempo federal income revenue enhancement render with the form and have the option to include taxation returns upwards to iii years in the past if yous believe it will help your case. This section also indicates the household member's full income (adjusted gross) reported on these tax returns. If you are counting additional assets to come across the financial requirement, indicate the values in lines 3.a–three.d.

Section 5: Sponsor'southward Hope, Statement, Contact Data, Declaration, Certification, and Signature

The primary sponsor volition need to impress their proper name and agree to support the immigrant listed on this form, in conjunction with the household member promising to accept liability under the Affidavit of Support. Post-obit the sponsor'southward promise, the intending immigrant's full name, date of nativity, Alien Registration Number, Social Security Number (if applicative), and USCIS account number (if applicative) demand to be written. If additional immigrants are being sponsored through this form, fill out their data as well.

If an interpreter aids in completing this form, the sponsor must declare they read every question and instruction to them. If the sponsor can read and empathize English and did not have a preparer or interpreter, check box 26.a. The rest of this section asks nearly the sponsor'due south contact data, followed past a announcement and certification of the data and documents provided.

Section half dozen: Household Fellow member'south Promise, Statement, Contact Information, Declaration, Certification, and Signature

The household member should take a thorough understanding of the penalties involved with agreeing to sponsor the intending immigrant considering the Affidavit of Back up. These considerations include:

- Promising to provide any/all fiscal support necessary to assist the sponsor in maintaining the sponsored immigrant at or in a higher place the minimum income provided for in the Immigration and Naturalization Act (no less than 125% of the Federal Poverty Guidelines) during the period the Affidavit of Support is enforced

- Agreeing to be jointly and severally liable for any payment owed past the sponsor under the Affirmation of Support to any Federal Government agency, any local or land agency, or local or private entity that provides means-tested public benefits to the immigrant

- Declaring under penalisation that the Federal income taxation returns you submit are true copies or unaltered transcripts filed with the IRS

- If you (household member) are likewise the sponsored immigrant, and then you agree to be jointly and severally liable to whatever obligation owed by the primary sponsor under the Affirmation of Back up to any of your dependents, Federal agency, organization, or entity that provides ways-tested benefits or financial support to assist the sponsor in maintaining your dependents at no less than 125% of the Federal Poverty guidelines

- If you are related to the sponsored immigrant or the sponsor by marriage and the marriage ended, you would still be responsible for the obligations in Class I-864A

- By consenting to this class, you also authorize the Social Security Administration to release information nigh yous in its records to the Section of Land and USCIS

The rest of Section six is similar to Section five. If an interpreter aids in completing this form, the household member must declare that they read every question and instruction to them.

Section 7: Interpreter's Contact Data, Certification, and Signature

If you used an interpreter, provide their full proper noun, business/organisation, mailing address, contact information, and certification in this department.

Section eight: Contact Information, Proclamation, and Signature of the Person Preparing this Contract, if Other than the Sponsor or Household Member

If you used a preparer, provide their total name, concern/organization, mailing address, contact information, and certification in this section.

Section 9: Boosted Information

This section is included should you need boosted space for any previous questions.

Y'all should provide the following documents along with Grade I-864A:

- Copy of sponsor's most contempo federal income tax render or IRS transcript

- A copy of every W-2 course and 1099 that corresponds with the sponsor's most recent federal income taxation return, if yous provided that

- Tax returns for the past three years if you lot believe it volition support your case

Oft Asked Questions

What is considered household size?

The household size is determined past counting yourself, whatsoever dependents or relatives living with you, and the intending immigrant.

A sponsor is defined equally either a petitioning relative (with or without ownership involvement in the intending immigrant), a substitute in cases where the original sponsor dies, a joint sponsor. Businesses, organizations, and enterprises cannot be considered a sponsor – only an individual can.

The answer depends on the size of your household, which includes yourself, any dependents, and relatives living with you lot in add-on to the immigrant you lot are sponsoring. You tin can see the complete 2021 Poverty Guidelines here. If your household size, for example, is four people, then the 125% income requirement is at least $33,125. The requirements differ slightly for residents of Alaska and Hawaii.

What should I do if I tin can't run across the income requirements?

A qualified immigration attorney is all-time suited to help you evaluate your options if you lot cannot meet the income requirements. All the same, some of your choices include adding in the greenbacks value of your avails (i.e., savings accounts, bonds, property), getting an eligible household member to help you sponsor the intending immigrant by pooling your income together or counting the income/assets of members of your household who are related to you lot through birth, marriage or adoption (they must be listed equally dependents on your nigh contempo tax render and lived with y'all the by 6 months). Another selection is to count the assets of the immigrant relative you are sponsoring.

Can my roommate sign the I-864A?

Unless the roommate is a relative, parent, adult child, spouse, or sibling of the principal sponsor or lawfully claimed as a dependent on your virtually contempo federal tax render, and so they cannot sign it.

If the intending immigrant's income is included with the sponsor'due south income on Form I-864, then they would merely need to complete the I-864A if they have accompanying dependents. Even so, if merely the immigrant'due south assets are included on Form I-864, then they do non need to complete the I-864A even if they have accompanying dependents.

What is the filing fee for Form I-864A?

There is no fee to file Form I-864A with USCIS.

Do I have to attend an interview with USCIS?

In some instances, USCIS tin crave an interview or that you provide your fingerprints, photograph, or additional information to verify your identity.

Source: https://www.immi-usa.com/i-864a/

0 Response to "How to Upload Multiple Pages for I-864a"

Post a Comment